OR Home Loan Source

- 888.844.7077

OR Home Loan Source

Currently serving all communities in Oregon

Our team has the expertise to make buying a home the amazing experience it should be.

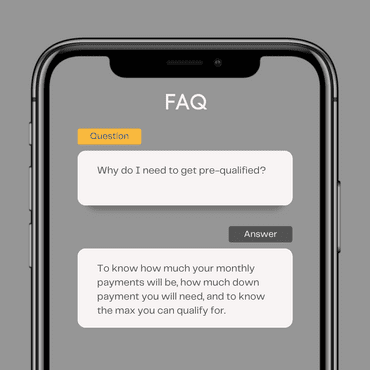

What is a mortgage pre-qualification?

Once you’ve made the decision that you want to purchase a home, the next step you need to take is finding out how much home you can qualify for, and if there’s anything special you’ll need to do based on your unique circumstances.

You can also use this step to identify different financial moves you can make to make this one of the best financial decisions of your life.

A mortgage pre-qualification will give you an idea of how much monthly payment will get you the house you’re looking for, how much down payment you’ll need, the maximum amount that you’ll qualify for, and any other questions about a mortgage that you have!

Got Questions? Call 888.844.7077

Do I have to have perfect credit?

It helps, but is not required. Most homebuyers, especially first-time homebuyers, will not have perfect credit. The truth is that credit is only one piece of the puzzle.

Other items that are considered are down payment, debt-to-income ratio (how much money you make vs. how much debt you have), reliable income, and rental history.

- Perfect credit is not a requirement for a home loan.

- Credit scores change every month.

- A full picture of your qualification is considered, credit is just one part.

Know Your Numbers...

Get answers to all your questions about how to qualify today!

Find Out How Much House You can Qualify For Today!

No advertisement or solicitation from 1hrm.com is meant to be a mortgage brokering activity or mortgage lending activity. All brokering or lending activities can only be completed by a licensed loan originator. To see if your loan officer is licensed in your state, please go to http://www.nmlsconsumeraccess.org/